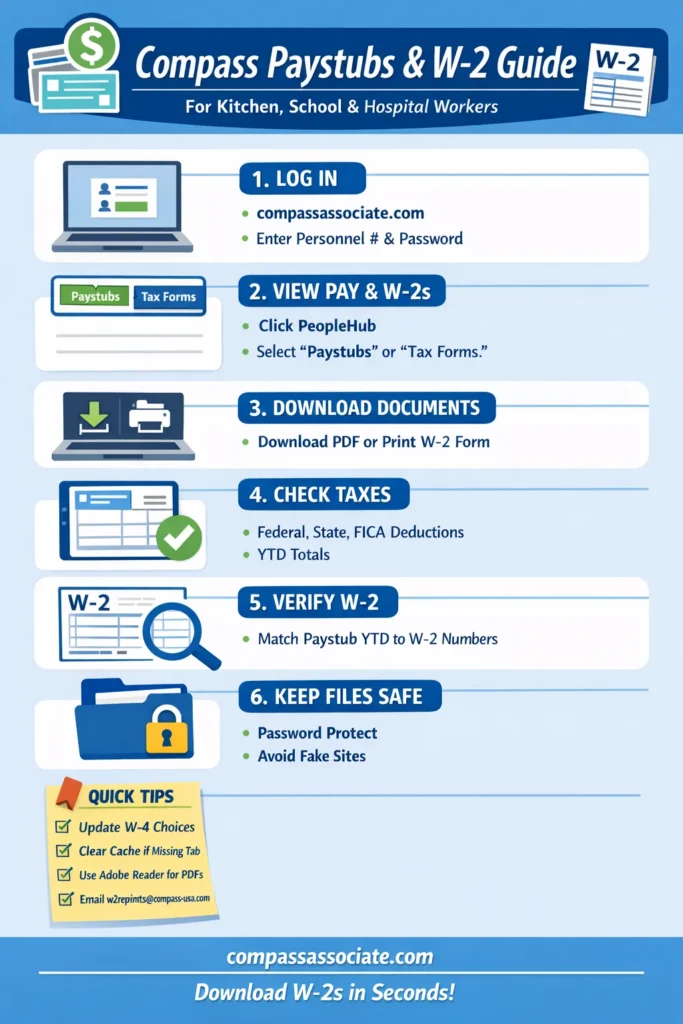

Ess Compass Associate com W-2 Guide

Compass associates see taxes and get tax documents through the ESS portal. Kitchen, school, and hospital workers check federal and state taxes, Social Security, Medicare, local taxes, and download W-2s for tax filing.

Login to ESS Compass

- Go to compassassociate.com.

- Enter your personnel number and password.

- Click the PeopleHub icon to see the full menu.

Mobile: Use ess.compassassociate.com. The workflow is the same on phones and tablets.

Find Paystubs and W-2 Forms

- Click PeopleHub.

- Select Paystubs or Tax Forms / Payroll Information.

- W-2 list shows 2025, 2024, 2023, 2022.

- Click the year you need. The PDF opens instantly.

- Click Download to save. Use Print if you want a paper copy.

W-2 forms post after January 31 every year. 2025 forms now show full-year earnings and taxes withheld.

Electronic W-2 Consent

- New hires pick electronic W-2 during registration. Saves paper and mailing.

- Change anytime: PeopleHub → Federal/State Withholding Taxes → electronic delivery. Confirm your work email.

Taxes on Paystubs

Compass associates see these taxes every week:

| Tax Type | Rate | Cap or Limit |

|---|---|---|

| Federal Income | W-4 based | None |

| State Income | Site specific | None |

| Social Security | 6.2% | $168,600 year |

| Medicare | 1.45% | None |

| Additional Medicare | 0.9% | Over $200,000 year |

| Local/School | Varies | None |

Federal Income Tax

Federal tax depends on your W-4 choices.

- Single with zero allowances → higher tax

- Married with dependents → lower tax

Paystub shows tax this week and YTD totals.

Example: $640 gross pay for a single filer takes about $65 federal tax. Update W-4 in PeopleHub; next stub shows changes.

State Income Tax

State tax depends on work location.

- California may take 8% in higher brackets

- Texas takes zero

- Some sites add city or school taxes

Paystub shows state tax this week and YTD totals. Multi-state workers see separate lines.

Social Security

- Rate: 6.2% of wages

- 2026 cap: $168,600

- Example: $640 gross → $39.68 per week

- YTD totals track toward cap

Medicare

- Rate: 1.45% of all wages, no cap

- Extra 0.9% over $200,000

Combined FICA: 7.65% per week.

Local Taxes

Some sites add local or school taxes.

- Example: hospital district 1%, school levy 0.5%

- Paystub shows each line separately

- Total can reach 12% of gross pay

Pre-Tax Deductions

Pre-tax deductions lower taxable income.

- 401(k) contributions

- Health insurance

Example: $50 weekly 401(k) lowers $640 gross to $590 before tax. Paystubs show pre-tax deductions above taxes.

Year-to-Date (YTD) Totals

YTD totals show taxes withheld all year.

- January shows week one totals

- December predicts exact W-2 amounts

Check YTD totals to spot mistakes and avoid surprises.

What W-2 Shows?

| W-2 Box | Details Listed |

|---|---|

| Box 1 | Wages, tips, other compensation (YTD) |

| Box 2 | Federal tax withheld (full year) |

| Box 3 | Social Security wages (up to cap) |

| Box 4 | Social Security tax withheld |

| Box 5 | Medicare wages (all earnings) |

| Box 6 | Medicare tax withheld |

| Box 16 | State wages and tax withheld |

| Box 17 | State ID number |

Check YTD paystub totals match W-2 boxes.

Former Associates

- Access ends 30 days after last shift

- Email w2reprints@compass-usa.com with personnel number and full name

- HR can print if you show ID

- Paper mail can take two weeks

Common W-2 Download Fixes

- Missing after Feb 1 → check electronic consent; HR may mail paper

- PDF won’t open → update Adobe Reader or use desktop

- No Tax Forms tab → clear cache; manager verifies active status

- Locked account → supervisor unlocks onsite in five minutes

Take screenshot confirmation. Save in W-2 Records folder by year.

Mobile App Limits

- Compass Time app shows paystubs only

- W-2s remain web-only for IRS security rules

Verify W-2 Against Paystubs

- December YTD totals predict W-2 numbers

- Box 1 wages should match gross pay YTD

- Box 2 federal tax should match YTD federal taxes

Report mistakes to payroll before IRS gets your W-2.

Keep Files Secure

- Save PDFs in a password-protected folder

- Delete phones after tax filing

- Type compassassociate.com directly

- Avoid public WiFi logins and fake sites

Key Takeaway

Compass associates can.

- Check taxes weekly

- Track YTD totals

- Download W-2s in seconds

- Verify pre-tax deductions

- Keep documents safe

Kitchen, school, and hospital workers can file taxes fast. Check compassassociate.com every January to stay ready for the IRS.

(Tested CAP Paystubs W-2 flow January 2026 matches associate screens.)

Compass associates access W-2 forms through ESS portal Tax Forms section. Active employees download 2025 forms now through three prior years. Kitchen school hospital workers grab PDFs fast for tax filing no HR desk needed.

Login to ESS Compass First

Start at compassassociate.com personnel number password. Dashboard shows PeopleHub icon click it opens full menu. Mobile uses ess.compassassociate.com same flow works phones tablets.

Find W-2 Forms Easy Steps

- Click PeopleHub from home screen.

- Select Tax Forms or Payroll Information tab.

- List shows available years 2025 2024 2023 2022.

- Pick year clicks open W-2 PDF instant view.

- Download button saves device Print icon spits paper.

Forms post January 31 IRS deadline yearly. 2025 W-2s live now show full year earnings taxes withheld.

Electronic W-2 Consent Required

New hires pick online during registration. Consent screen asks Yes electronic saves paper mail costs.

Change anytime PeopleHub Federal State Withholding Taxes. Select electronic delivery confirm work email receives notice.

What W-2 Shows Associates

| W-2 Box | Details Listed |

|---|---|

| Box 1 | Wages tips other compensation YTD |

| Box 2 | Federal tax withheld full year |

| Box 3 | Social Security wages up to cap |

| Box 4 | Social Security tax withheld |

| Box 5 | Medicare wages all earnings |

| Box 6 | Medicare tax withheld |

| Box 16 | State wages tax withheld |

| Box 17 | State ID number |

YTD paystub totals match W-2 boxes perfect verify before IRS files.

Former Associates W-2 Access

30 days after last shift portal locks. Email w2reprints@compass-usa.com personnel number full name.

HR desk any site prints ID proof required. Paper mail takes two weeks processing slow tax season.

Common W-2 Download Fixes

- Form missing after Feb 1 Check electronic consent HR mails paper copy.

- PDF blocks desktop Adobe Reader mobile Chrome better.

- No Tax Forms tab clear cache manager verifies active status.

- Locked account supervisor unlocks onsite five minutes.

Screenshot download confirmation date folder W-2 Records organized.

Mobile App W-2 Limits

Compass Time app shows paystubs only. W-2s stay web IRS security rules full year forms portal exclusive.

Verify W-2 Against Paystubs

December YTD totals predict W-2 box numbers. Box 1 wages matches gross pay YTD Box 2 federal matches tax YTD.

Spot errors payroll before IRS receives copy tax refund safe.

Keep W-2 Files Secure Strict

SSN full in forms password protect folder. Delete phones yearly after tax file. Fake compassassociate.com steals tax data type URL direct public WiFi blocks login.

ESS Compass associates download W-2s ten seconds PeopleHub Tax Forms. Kitchen school hospital workers file taxes fast loans verify income digital proof instant. Check compassassociate.com yearly January stay IRS ready always.